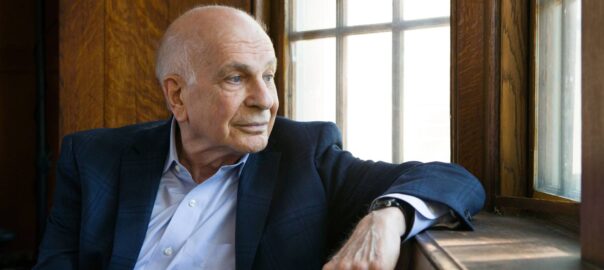

I’m late to the party in my fandom of Scott Galloway. I got to know him from his joint podcast with Kara Swisher, Pivot. I’ve come to admire his solid analysis of business and politics, and especially, as someone in my age bracket, his concern for the emotional wellbeing of young men. (You can hear his incisive views on that subject, in his typical iconoclastic framing, at the 1:09:35 timestamp of this episode.) Now I’ve also subscribed to his solo podcast, Prof G, and today that led me to this essay about the passing of the great Daniel Kahneman this year, pictured above, and how Galloway applies this Nobel Prize winner’s principles from Thinking, Fast and Slow, Kahneman’s breakout book.

His premise is that we need to stop and think before acting. This sounds obvious, but as he explains in the essay, it’s far harder to put into practice than you’d think. Kahneman was the first to hypothesize upon, and prove the existence of, some profound cognitive biases we all possess, especially Loss Aversion. Kahneman describes in great detail how this influences our decisions — when we are thinking fast. It has since been shown to also exist in “lesser” primates, suggesting that we applied loss aversion when we were still swinging from tree branches by our tails.

Kahneman also wrote about how, since we make thousands of decisions per day, we tend to do more “fast thinking” as we become fatigued. If (or should I say when?) you break your 2025 New Year’s resolutions of eating fewer sweets, or drinking less, or doing less scrolling on social media, consider the time of day. You’ll likely find that you made the wrong decision, and fell back onto fast thinking, when you were most tired.

How To Bank Your Limited Daily Allotment of Slow Thinking Decisions

Maybe I like Galloway’s tribute to Kahneman because I apply similar rules as he does, to preserve thought energy for things that matter. He writes:

I actively limit the number of decisions I have to make to preserve neuron power for the key ones. I have other people order for me at restaurants [and] I have a uniform for work / working out, wearing the same thing every day.

Yep, that’s me as well. And maybe my admiration for Galloway just shows that I am susceptible to another damning cognitive bias, Confirmation Bias. It goes like this: He must be smart because I fancy myself smart as well, and he acts the way I do. Come to think of it, this is definitely true. And I’m also — more often than I’d like — the victim of myself in the sin of loss aversion. Here’s an example I’m not proud of:

During the pandemic, when my last employer included me in its efforts to deliver on quarterly profits and told me I was being let go, one of the very first actions I took seemed smart at the time. Without consulting anyone, that very day, I sold my 14 Ethereum “Ethers.” I told myself I could not endure another loss, so the crytocurrency I had purchased at $210 each, I sold for somewhere around $440. My fast thinking rationale was it could add to my considerable financial cushion at a 2x profit.

If I had held onto that $6,000 investment, purchased at half that amount, today I could have sold them for $47,000. Remember how I said my financial cushion was considerable? Well, so were my employment prospects, which someone could have helped me realize, applying slow thinking.

Seventy-five days after my last day of employment there, I joined my current employer.

Luckily, I’ve lectured on the power of loss aversion — the source of every dollar of profit at every casino blackjack table and within every insurance policy. I know its power and forgave myself for being an advanced primate. Anyway, crypto is way too volitile to be trusted. Good riddance.

More importantly, I also know, in advance, the breakfast and dinner I’ll eat every upcoming weekday, and the workout and work clothes I’ll wear every day until either I or that limited clothing selection fall apart.

Like Professor Galloway, I’m saving neuron power for the important decisions in 2025.

Photo credit Princeton University